Dubai has been the golden hub for the yellow market, globally, attracting investors from around the world. Whilst it is true that the prices offered in Dubai are quite competitive, and are also supreme with their excellent quality provided in terms of purity, it steals the show because of its tax-friendly environment.

A tax-free haven for gold, the dazzling metropolis of Dubai blends the futuristic skylines with ancient traditions that have long captivated the world. Beneath its glittering facade, there is a catchy for savvy investors. As investorsrs, buying gold is successful when one can extract the Tax advantages of Gold Investment in Dubai.

A fascinating fact – Dubai boasts the world’s largest gold refinery and is responsible for a staggering 30% of global gold trade and this dominance makes them feature in the top three physical gold trade hubs.

This is not just about geographical convenience, a powerful incentive fuels it; the absence of VAT (Value Added Tax) on gold bullion and jewellery purchases.

Tax Planning in Dubai is only easier and more profitable when you know the taxes and their implications.Gold purchases are intentionally for investment purposes, and as investors, one should always be aware of the tax considerations. The reason why investors seek dubai is because of the tax benefits they acquire in Dubai:

In simple terms, this tax is paid as a percentage of the profit earned after selling an asset like stock or real estate, even gold as an asset class.

In the context of gold and Dubai, there is no tax imposition, making the investor firm in seeking gold investments. Saving money in gold becomes more profitable since no apportionment goes in as taxes.

The inheritance tax is a tax that is paid upon receiving an inheritance. It is calculated by deducting the debts from the deceased person's net assets, or the assets he held less the obligations. To put it simply, inheritance is the collection of possessions and rights that pass to heirs upon a person's death.

Gold, even as an investment, is purchased for long-term purposes, to preserve wealth that can be passed down to generations. It is delightful to know that there is no inheritance tax in Dubai.

Value-added tax is an indirect tax that acts as a special tax on purchases regardless of your income band. As of 2024, the UAE government declared no VAT on gold.

This complete exemption of VAT is one of the strongest pursuits for investors from all over the world to divert investments in Dubai.

From other countries that impose 5 to 20% of VAT, it is without a doubt that investment in Dubai is cheaper and better.

For newcomers in particular, the VAT exemption on gold dealing and investments in the United Arab Emirates is revolutionary. Enhanced market activity and streamlined transactions are advantageous for gold dealers and jewellers.

Investors believe gold to be a more attractive investment and appreciate straightforward pricing. Customers might not notice a price decrease right away, but as competition increases, gold prices could rise.

All things considered, the exemption improves the transparency and affordability of the gold trading market, which is advantageous to both companies and private consumers.

The inclusiveness of Dubai's gold market is what makes it so beautiful. Regardless of your financial situation or investment objectives, there is a way to take advantage of this fantastic opportunity.

Keeping physical gold bars is the more conventional approach, but it also provides a sense of concrete security and ownership of a priceless possession. Reputable institutions and dealers provide secure vaults that guarantee the security of your precious metals.

Exchange Traded Funds (ETFs) are a handy way to invest in gold for individuals looking for a more liquid option. These exchange-traded funds (ETFs) allow you to profit from market swings without holding actual gold by tracking the price of the metal. They are traded on the Dubai Gold & Commodities Exchange (DGCX).

Even though tax-free gold has an irresistible appeal, you should think about a few things before investing:

It's important to secure physical gold if you decide to use it. A network of safe deposit boxes supplied by banks and merchants is available in Dubai.

Learn about the import laws governing gold in your nation before bringing your newly discovered treasure home. It may be necessary to take import duties or quantity restrictions into account.

An investor would want to maximize their return, not just through the compounding rate of return, but also what they can save on taxes. To maximize their tax benefit in Dubai, there are several tips to keep in mind.

First of all, it is always preferred and recommended to seek professional advice from a financial planner or a tax specialist who is familiar with taxes in Dubai. Tax regulations change and to keep up to date, consulting someone always gives you the edge.

Secondly, diversification is another golden strategy for an effective outcome. By spreading investment in different asset classes and jurisdictions, one can always reduce their tax exposure and maximize the returns.

Dubai is a gold mine of opportunity for investors worldwide due to its unique combination of tax advantages, a well-regulated market, and a variety of investment opportunities. Dubai offers both the freedom of ETFs and the security of actual bullion.

Utilizing the knowledge of a trustworthy gold bullion company such as ours will enable you to confidently negotiate the market's complexities. We provide a wide range of premium gold goods, safe storage options, and professional advice to assist you in making wise investment choices.

Don't let this fantastic opportunity pass you by. Get started on your investment journey in Dubai's booming gold market by visiting our website today. Speak with one of our specialists to learn more about the solutions that best meet your financial objectives.

Remember, in Dubai, gold does glitter brighter

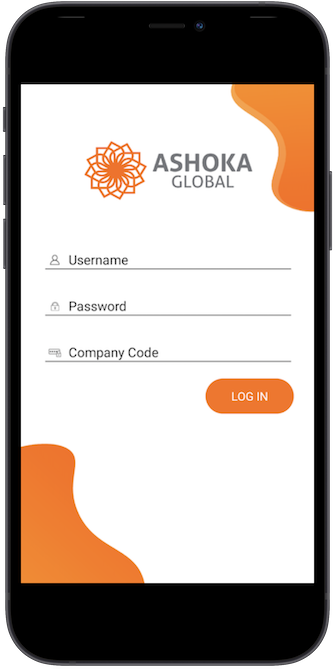

We are pleased to announce that Ashoka Global’s Mobile Trader application is now available in Play Store and App Store. From this App, you can make the main trading functionalities at your fingertips anytime anywhere using your Android or iOS Device.